Investment Update: Impact of changes to debt rating

Monday 30th of March 2020

On Friday night, Fitch downgraded the government debt rating for the UK to AA- from AA. Fitch is one of the top three independent agencies (the others being Moody’s and Standard & Poors) that assess the risk of companies or governments not being able to pay back their debt. It is nothing to worry about for the UK as our debt is still close to the top rating on a scale that runs from AAA to BBB in investment grade with 11 possible levels based on intermediate classifications of +/-. The Fitch ratings break down as shown below. Each agency h...

Investment Update: The Outlook Is Improving

Friday 27th of March 2020

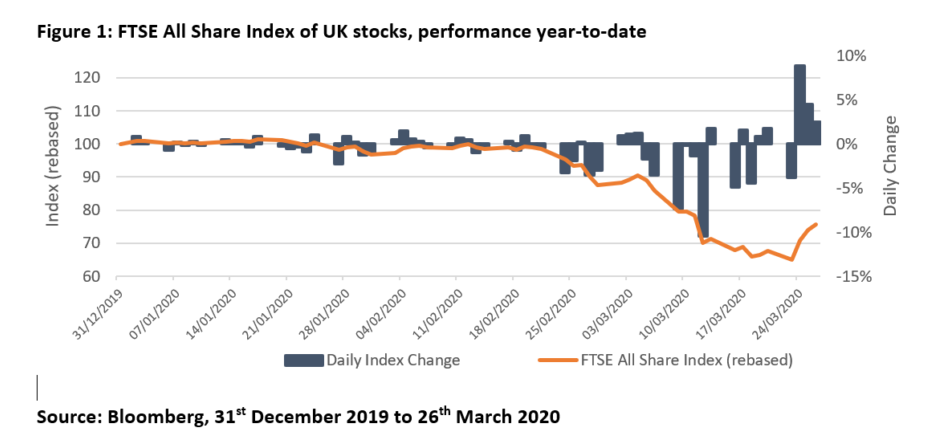

In recent weeks, investors may have become accustomed to seeing markets lurch lower day by day. The gains made this week – by some measures the strongest since 1931 – are therefore particularly welcome. While it is too early to sound the all clear, and while we would caution against attempts to ‘call the bottom of the market’, we believe the outlook is improving. Consequently, at current levels, we see compelling opportunities for longer-term investors in stock markets.

As previously explained (see ‘There Is A Path Out Of This’), we...

Financial Support for businesses and employees

Tuesday 24th of March 2020

Current Schemes

1. Coronavirus Business Interruption Loan Scheme

The Chancellor announced support for small businesses in the budget on 11 March. Details are subject to clarification but the scheme has been extended and brought forward to 23 March.

It will be provided through participating provider banks and will offer more attractive terms for both businesses applying for new facilities and lenders, with the aim of supporting the continued provision of finance to UK businesses during the Covid-19 outbreak.

The scheme provides the lende...

Market Update: Turbulent week for markets as coronavirus continues to spread West

Monday 23rd of March 2020

LAST WEEK – KEY TAKEAWAYS

Markets: Shares fluctuate despite government and central bank measures

- Global shares fell sharply at the start of the week after governments introduced stricter rules to contain the spread of the coronavirus;

- Further support from governments and central banks helped stock markets recover slightly on Tuesday, but they dropped again on Wednesday as concerns about the impact of the virus on the global economy returned;

- Those concerns also weighed on government bonds- usually considered a safe have asset in times ...

Omnis Investment Update: Focus on the Horizon

Friday 20th of March 2020

Focus on the Horizon

As the coronavirus has continued to spread around the globe, financial markets have become increasingly turbulent. The S&P 500 index of US stocks has risen or fallen by 4% or more on each of the past eight trading days while volatility (as measured by the Vix index, otherwise known as ‘Wall Street’s fear gauge’) has surpassed that seen even at the peak of the financial crisis.

Navigating these stormy waters is undeniably challenging. However, we are reminded of the advice often given to sea-sick sailors: pick a p...

Coming to terms with market turbulence

Friday 20th of March 2020

Coming to terms with market turbulence

As a direct consequence of the COVID-19 outbreak, global stock markets are suffering a period of turbulence. When markets move significantly it can prove very challenging to hear through the noise and focus on the bigger picture.

Lessons from history

Over recent years many investors have become used to a variety of political, financial and economic factors impacting markets, from the Brexit Referendum and subsequent prolonged uncertainty, to the global financial crisis and even further back to the do...

Government announces three-month mortgage holiday in Covid-19 package

Wednesday 18th of March 2020

You may be aware that on March 17, Chancellor Rishi Sunak confirmed that anyone struggling financially as a result of the Coronavirus outbreak will be able to take a three-month mortgage repayment holiday.

A number of lenders had already announced repayment holidays for those affected by Covid-19, but the Government's announcement means ALL lenders will now have to honour the three-month time frame.

A mortgage payment holiday is an agreement you will need make with your lender allowing you to temporarily stop or reduce your monthly mortgag...

Market Update: Global shares fall as spread of coronavirus rattles markets

Tuesday 17th of March 2020

LAST WEEK – KEY TAKEAWAYS

Coronavirus: Toughest week for markets in over 30 years

- Global shares fell at the start of the week after a disagreement between the Organization of the Petroleum Exporting Countries (OPEC) and other producers about cutting output led to a drop in oil prices;

- On Wednesday, concerns about the market for Treasuries- US government bonds which are considered among the least risky asset class as the likelihood of default is so low- further weighed on shares;

- Later that day, US President Donald Trump banned travel f...

Omnis Investment Update - US travel ban weighs on European shares

Monday 16th of March 2020

Global shares fell again this morning after US President Donald Trump banned travel from most European countries to the US in an effort to contain the coronavirus. The ban only applies to people, not goods, from countries within the Schengen common visa area (so it does not include the UK) and lasts for 30 days.

The FTSE 100 and the Stoxx 600 index of European shares both fell 6% when the stock markets opened, with the travel and leisure sectors coming under the most pressure. Oil prices, which weighed on the markets at the start of the wee...

What does the new budget mean for pensions?

Monday 16th of March 2020

State pensions

The new single-tier State Pension will increase from £168.60 a week to £175.20 in April 2020. For pensioners receiving the older basic State Pension, this will increase from £129.20 to £134.25 per week (3.9% increase). For spouses/civil partners this will increase to £80.45 per week.

The rise is the result of the triple-lock system, which means that the State Pension rises in line with inflation, earnings or 2.5%, whichever is the highest.

Private pensions

To support the delivery of public services, particularly in the NHS...